Over the years, there have been various stories about Elon Musk’s higher-than-normal risk tolerance, and his willingness to take major chances on things, despite the potential impacts that may come, to himself and to his companies.

We’ve seen that with X s well, with Musk randomly ripping out servers and cutting staff, despite not knowing, for sure, what the actual outcome of such might be. Such actions, despite carrying significant risk, have turned out fine (in relative terms), and it’s this gung-ho, action-first approach that many attribute to Elon’s ongoing business success.

Which is what came to mind when I saw today’s announcement that X is partnering with Kalshi to provide Grok insights within Kalshi’s market prediction overviews.

As you can see in this example, market analytics platform Kalshi will now be able to display contextual insights from Grok within its stock overviews, providing more data for investors to incorporate into their buying and selling approach.

Which makes sense, in helping investors make more sense of what’s happening. But then again, there is a line that needs to be drawn between adding insight, and influencing investment decisions, based on what an AI bot says.

Because that seems pretty risky. If an investor loses out because Grok told them not to buy in, that would be considered direct financial advice, and the FTC has some pretty strict rules around that element. Because it’s so risky, because it can have a major impact, yet X is stepping into this with seemingly little regard for potential fallout in this respect.

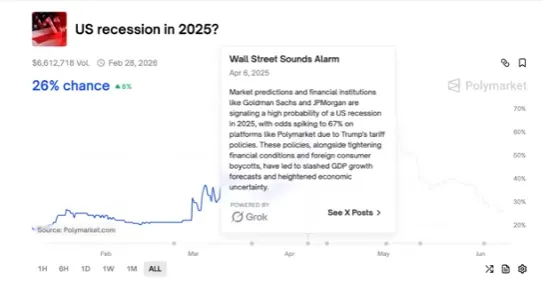

X also announced a similar deal with Polymarket last month, with Polymarket now able to incorporate predictions based on X posts, along with insights from xAI’s Grok system, to provide contextual pointers for its forecasts.

And both of these activations present the same level of risk in providing financial advice, or financial-type advice, via AI means.

It seems like a potential lawsuit waiting to happen, particularly when you also consider Elon Musk’s own business ties, and how these advice notes could link back to them.

Indeed, the FTC advises that:

“If you endorse a product through social media, your endorsement message should make it obvious when you have a relationship (‘material connection’) with the brand. A ‘material connection’ to the brand includes a personal, family, or employment relationship or a financial relationship – such as the brand paying you or giving you free or discounted products or services.”

That’s more specifically related to influencer endorsement, but the same rules would apply to AI tools as well. And with Elon having a hand in various stock impacting elements, and with xAI looking to angle Grok to better align with his personal views, it seems like only a matter of time before both of these partnerships lead to at least some issues on this front.

But again, Elon is fine with higher levels of risk than most. And with X’s “everything app” vision being largely centered on finance, and enabling people to manage their entire financial life within the app, investment integrations make sense in that broader scope.

I’m just not sure there are clear enough parameters as yet around the use of AI for stock advice, and for X specifically to be facilitating such.