Meta’s ongoing court battle against the FTC, which could result in Meta being forced to sell Instagram and WhatsApp due to anti-competitive concerns, has seen the company reveal a range of insights, as part of its broader effort to highlight that it doesn’t hold a monopoly share of the digital ads market, and that there are, in fact, significant competitors challenging Meta’s perceived dominance in this space.

And while a lot of this is circumstantial, and not particularly illustrative in a general sense, there are some interesting data notes that have been presented in the trial which could give advertisers some more perspective on key social media usage trends, and better inform their strategies.

Here’s an overview of some of the graphs and stats that have been presented in the case.

First off, if you were still unclear, video is the focus on Facebook:

As you can see, more and more people are spending more and more time watching video on Facebook.

And Reels specifically have been the big winner over time:

As shown here, general Facebook News Feed engagement has dipped, and Facebook Stories have never really caught on, but Reels continues to rise, as Meta pushes more and more of them in front of its audience.

Which is probably no big surprise. Meta has credited its shift to an algorithm-defined feed of recommended Reels for increasing engagement on both Facebook and IG, and as a general user, you’ve no doubt become accustomed to the constant stream of videos in each app.

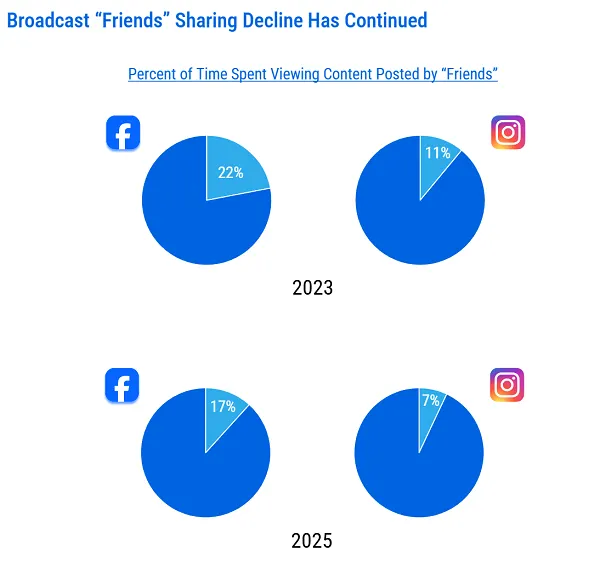

But this is also worth noting from a usage trends perspective, and understanding what people come to Facebook and Instagram for these days.

In its opening statement, Meta also noted that 63x more messages are sent in its apps every day, versus public posts, further reiterating the broader shift towards video for entertainment, and messaging for connection.

Public posting is simply not a major element of Facebook or IG anymore.

So what does that mean for marketers?

Well, if people are being entertained in these apps, then getting your ads in front of them is still likely to be just as effective as it was when the focus was on friend sharing. But it is worth noting that real engagement happens in DMs, and as such, DMs may now offer a better pathway to facilitating transactional connection.

Which is why Meta’s Click-to-Message ads have seen a rise in interest of late.

It’s also why the platforms are making creators a bigger focus, because general users aren’t posting anyway. If social apps want to keep people coming back, they need to focus on what incentivizes creators to post, in order to keep their content streams flowing.

In terms of what content specifically, video is clearly where it’s at, and if you’re not creating video content, you should definitely be considering it.

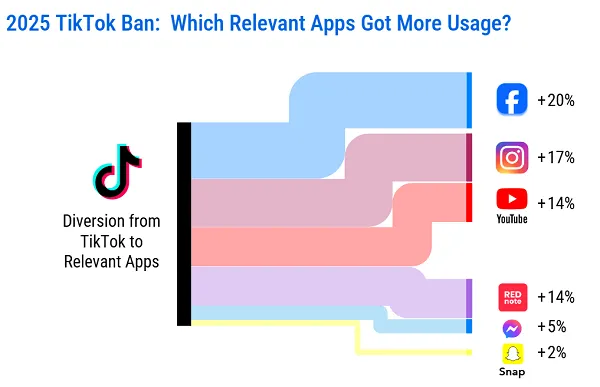

Meta also shared insights into which apps benefited most when TikTok was temporarily banned in the U.S.

So if TikTok is eventually kicked out of America, due to the “Protecting Americans from Foreign Adversary Controlled Applications Act,” you can likely expect Facebook, Instagram, and YouTube to scoop up most of that traffic.

Meta’s also noted the increasing similarity between apps, with every platform copycatting each other.

Again, no surprises here, but it is interesting to note the gradual convergence of features, and the lack of differentiation between platforms as a result.

These are just some of the revelations from the Meta FTC trial, providing a rare glimpse into the actual working data from inside Meta HQ.

If you were looking to get a better understanding of broader social media trends, these will do it.