Meta has published its latest performance update, showing steady increases in revenue and usage, as it continues to invest big on the AI and VR future.

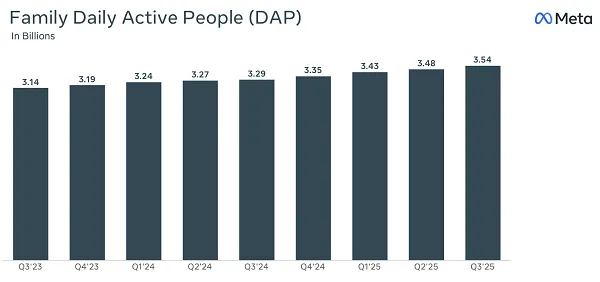

First off, on users. Meta added 60 million more users across its suite of apps in Q3, taking it to 3.54 billion overall.

Which is steady growth, especially considering that both Facebook and IG would be reaching saturation point in many markets. But Meta continues to gain users in developing regions, while the growth of Threads would also be contributing to overall usage growth.

We don’t have platform-specific data, only this cumulative counter for all unique users across Facebook, Instagram, Messenger, WhatsApp and Threads. But the top-line figure shows that Meta continues to steadily add more users over time, despite its already massive scale.

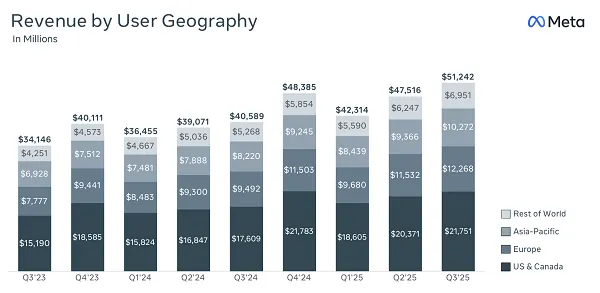

In terms of revenue, Meta brought in $51.24 billion in Q3, an increase of 26% year-over-year.

Meta still generates the vast majority of its income from its ad business (97%), and from its audience in the U.S., though it is diversifying over time, with sales of its AI glasses continuing to rise, and other offerings, like Meta Verified, feeding into that overall result.

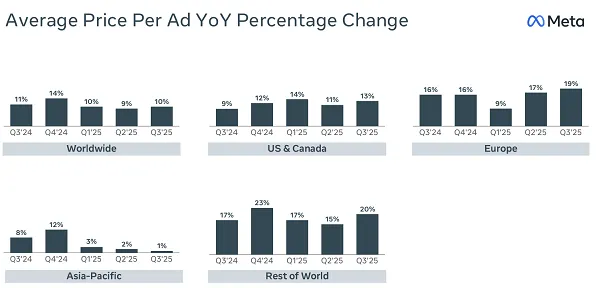

Though this graph probably doesn’t make marketing folk especially giddy:

On AI and AR glasses, Meta has just released its ‘Display’ model, which includes a heads-up display and wrist controller, while it’s also announced plans to ship its fully AR-enabled glasses out to developers next year, with a view to a 2027 retail launch.

Eventually, Meta’s hoping that AI-powered glasses will replace smartphones as our key connective device, and if that happens, that could see them become a much bigger contributor to Meta’s revenue pie.

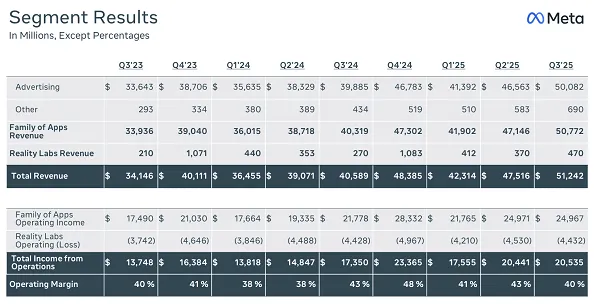

But right now, expenses in its Reality Labs division remain high, offsetting better sales numbers.

Reality Labs posted a $4.4 billion loss in Q3:

Oh, also this:

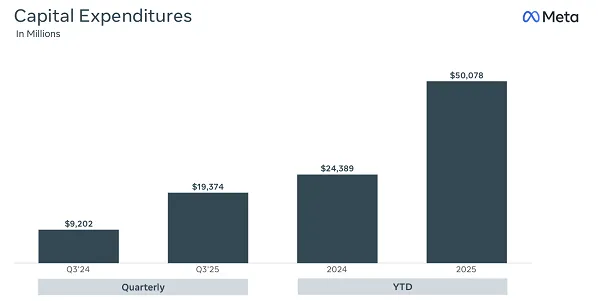

Meta’s investing billions upon billions into AI, with Zuckerberg predicting back in January that it’ll likely invest around $65 billion into AI infrastructure this year alone. That’ll largely go towards building massive new data centers to power its superintelligence push. And it now looks like its outlay might actually get even higher than Zuck’s initial forecast.

As per Meta:

“As we have begun to plan for next year, it has become clear that our compute needs have continued to expand meaningfully, including versus our expectations last quarter. We are still working through our capacity plans for next year, but we expect to invest aggressively to meet these needs both by building our own infrastructure and contracting with third party cloud providers. As a result, our current expectation is that capital expenditures dollar growth will be notably larger in 2026 than 2025.”

That’s a lot of money flowing into AI projects. Indeed, earlier this month, Meta broke ground on a new $1.5 billion data facility in El Paso, Texas, which will become Meta’s 29th data infrastructure development in the U.S.

The need for so much investment will price many smaller players out of the AI race entirely, and likely, some of the bigger ones as well, with analysts already projecting tough times ahead for OpenAI and xAI, as more questions are raised about how that investment will eventually result in intake.

Meta, Google and Apple all have far more resources to expend in this respect, and that may well be the defining factor that dictates the eventual “winner” of the AI race.

But these projects will also have to produce real results, and demonstrate why they’re worth the cumulative trillions in investment. AI tools, thus far, have proven interesting, and beneficial in some respects, but not as transformational as the hype would suggest.

Can they get to that stage? Zuck and Co. are clearly betting that they will, and till there is a major pay off, those bets will continue to weigh on Meta’s earnings.

On another front, Meta’s also warned of the risks of impending regulation, in the U.S. and EU specifically.

“For example, in the EU, we continue to engage constructively with the European Commission on our Less Personalized Ads offering. However, we cannot rule out the Commission imposing further changes to that offering that could have a significant negative impact on our European revenue, as early as this quarter. In the U.S., a number of youth-related trials are scheduled for 2026, and may ultimately result in a material loss.”

As more regions consider teen social media bans and restrictions, social apps could end up losing out, which may also impact Meta’s longer-term revenue numbers.

But overall, the business itself remains solid, and really, a marvel in the modern landscape. And while there is risk in over-investing in AI and VR, technologies which have not yet proven significant market use case (relative to investment), Meta is also looking to place itself to dominate these areas, and set the foundation for ongoing business success.